Why stablecoin issuers and payment giants are racing to control the networks that move global money ?

Margins are at risk, fees are collapsing, and the race to own the rails has begun.

Disclaimer : This is a personal post. Views expressed in this article are my own and do not represent those of my employer.

At the intersection of business, technology, and geopolitics, a high-stakes battle is taking shape: who controls the future of money movement.

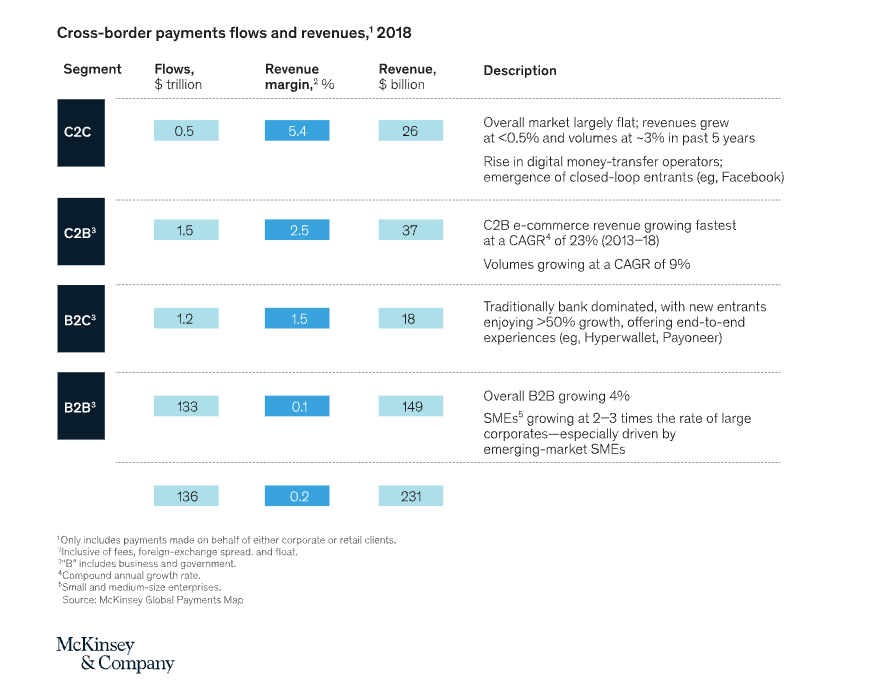

Every year, the global payments industry processes more than $2.2 quadrillion in transaction value and generates about $2.2 trillion in revenue (McKinsey, Global Payments Report 2024). Cross-border payments alone represent $200 billion in annual revenue, with margins that have historically made them one of the most profitable segments in finance.

This is why the question of who owns (or doesn’t own) the rails of the future matters so much :

For payment companies (and even banks), it’s an existential business problem: margins collapse when blockchain makes transfers nearly free.

For states, it’s geopolitical: if new rails are dominated by U.S. corporations, the rest of the world risks recreating the same dependency it already has with Visa, Mastercard, and SWIFT.

We are no longer debating whether blockchain will impact payments. That’s settled.

The real question is who will own the future infrastructure of money flows, and whether it will serve as a global public good or another layer of private chokepoints ?

Why stablecoin issuers need to control the rails

When I entered the stablecoin industry in 2020 and we launched Lugh, one of the first euro stablecoins, the first question I always got was simple and fair: how will you make money?

Back then, eurozone interest rates were pinned at zero. Our USD-based competitors were collecting juicy yields on U.S. Treasuries, but we had nothing. It was obvious from day one that building an entire business model on central bank policy was fragile. If Jerome Powell can erase significant portion of your topline with a single announcement, you don’t really have a sustainable business model.

And that’s only half the story.

The other big challenge is distribution costs. To scale, stablecoin issuers need exchanges, fintechs, wallets, and banks, the very gateways that put stablecoin in users’ hands. But those partnerships are not free.

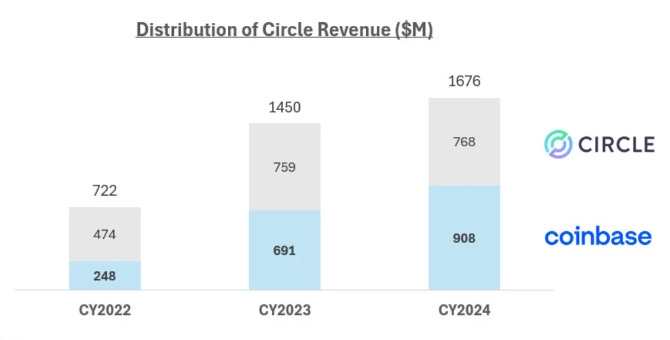

Circle’s IPO filings laid it bare: in 2023, Circle generated $1.7 billion in revenue, but paid almost $1 billion to distribution partners, with Coinbase alone taking about $900 million.

Taken together, these dynamics show that the stablecoin business model is under real pressure. Reliance on central bank rates leaves margins exposed, and heavy distribution costs limit profitability even as circulation grows. The only way to create new, sustainable revenue streams, is to own the underlying infrastructure.

That’s exactly what major issuers are doing: Circle with Arc and Tether with Plasma are building proprietary rails to control how their stablecoins move, capture value beyond interest yields, monetize settlement and transaction flows, and reduce reliance on intermediaries.

Why payment companies are also at risk

Legacy payment companies (especially those handling cross-border transfers) are facing the same structural problem.

Systems like correspondent banking and SWIFT have long enabled banks and networks to charge steep fees: $25–$50 per transfer, plus 1–3% in hidden FX markups. In remittances, it’s even worse: the World Bank reports an average cost of 6.4–6.5%, with banks charging up to 11.99% in some cases.

Now put that next to blockchain and stablecoins: instant settlement, near-zero cost. Savings can reach 80%, and transfers that used to cost tens or hundreds of dollars collapse to fractions of a cent.

Let’s size the impact:

Total B2B cross-border payments revenue: ~$200 billion annually (McKinsey)

Potential cost reduction with blockchain rails: 80% (PaymentsCMI)

Revenue at risk: $160 billion annually

The implication is clear: even a partial migration of B2B cross-border payments to blockchain rails could wipe out a massive portion of traditional payment revenue.

This structural threat explains why companies like Stripe are moving aggressively with Tempo. Tempo is a new Layer-1 blockchain built specifically with payments in mind, especially stablecoins. It was jointly incubated by Stripe and Paradigm. Rather than using a native token for fees, Tempo allows gas fees paid in stablecoins via an integrated automated market maker (AMM).

Here’s the strategic heart of it: if transaction costs go to zero, the only way to capture value is by owning the network itself.

That’s the exact playbook Visa and Mastercard used. By controlling the infrastructure, they monetized every swipe, extracted value from both merchants and consumers, and built trillion-dollar networks. Those networks have long been wielded as instruments of American power, capable of excluding entire countries, banks, or industries from the global financial system.

Political scientists Henry Farrell and Abraham Newman call this “weaponized interdependence” (2019): the U.S. can turn financial chokepoints like SWIFT, Visa, and Mastercard into tools of statecraft.

Geopolitics and the race for infrastructure

What makes this race so much more than a business story is the geopolitical dimension. In the U.S., private actors : world-leading stablecoin issuers like Circle and Tether, payment giants like Stripe, and even Big Tech (Google is entering in the race) are moving aggressively to build proprietary rails. Their goal is clear: capture global payment flows, monetize the network, and secure a competitive edge for decades.

In Europe, efforts are largely led by the public sector but remain more narrowly targeted. The digital euro and private initiatives such as Wero focus mainly on intra-European payments. Their purpose is framed around resilience, sovereignty, and consumer protection, rather than exerting influence over the global payments landscape.

But here’s the critical point: the bigger question isn’t private versus public.

It’s open versus closed networks.

If the infrastructure is private and controlled by a handful of U.S. corporations, the world risks repeating the same strategic dependencies we already have with Visa, Mastercard, and the dollar: access, influence, and even enforcement can be wielded as geopolitical tools.

That’s why I firmly believe neutral, open networks are essential. Systems like Ethereum may be imperfect but they are permissionless and open.

Nobody, no matter how powerful, can unilaterally weaponize them. Open networks protect sovereignty, competition, and innovation in a way that private rails simply cannot.

Final Thoughts

Europe has a choice. It can double down on regional, defensive initiatives, or it can embrace open, global, decentralized infrastructure as a strategic priority.

Looking ahead, the questions multiply. I don’t have a definitive answer to how this should play out. There are no simple solutions to balancing efficiency, security, compliance, and global coordination. But I do have a few thoughts on what’s desirable:

Neutral, open networks are critical. Permissionless systems like Ethereum offer a rare infrastructure where trust isn’t concentrated in any single corporation or state.

Global perspective matters. Regional initiatives are important, but the long-term goal should be open networks capable of handling global flows.

Competition and innovation should coexist with public good. Whoever builds the rails must avoid recreating chokepoints or dependencies that stifle sovereignty and resilience.